Should I Donate to Charity or Sell My Car? (PDF)

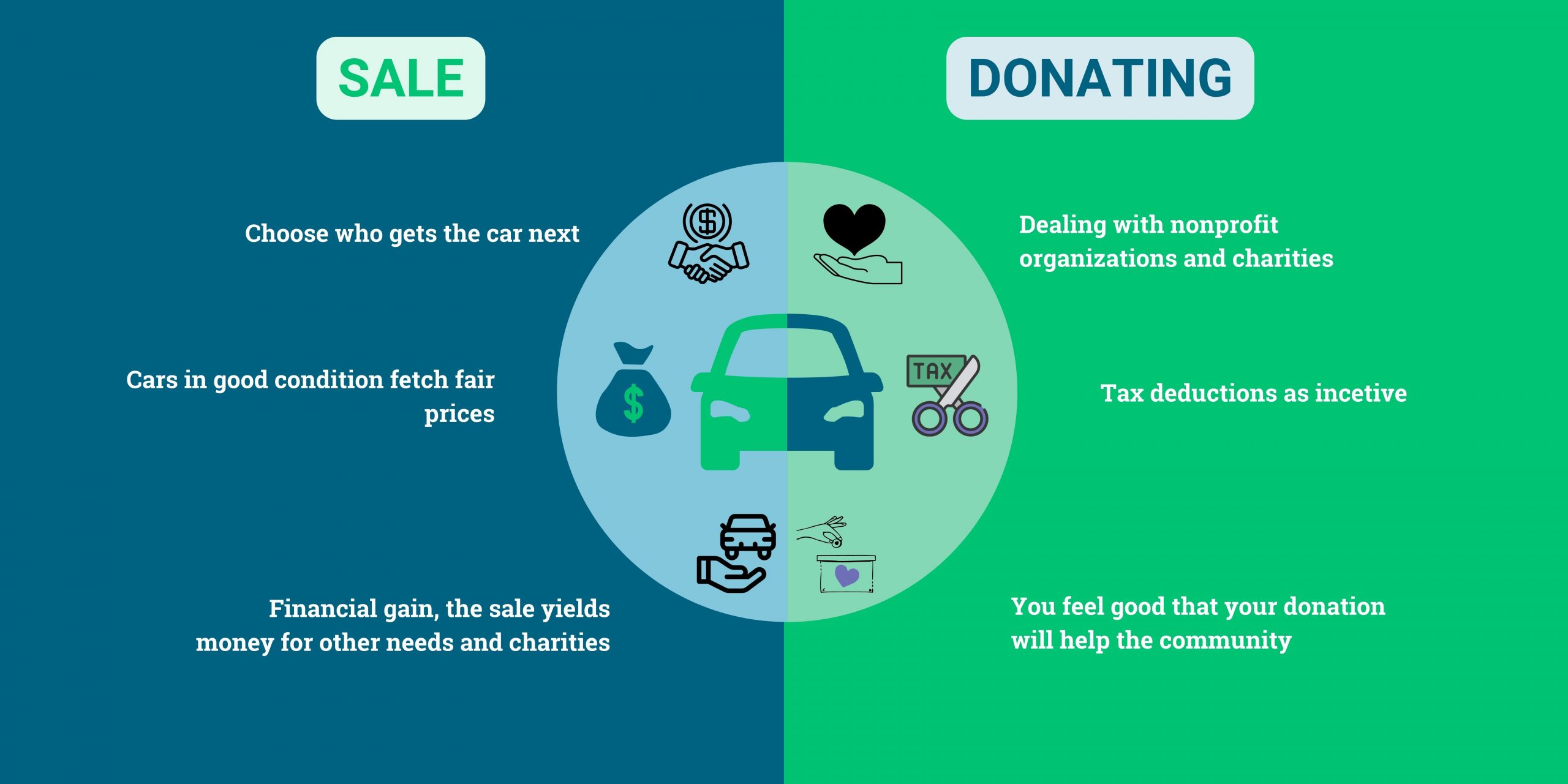

If you find yourself with a junk car that needs to be disposed of, you might be torn between selling it to a junkyard or donating it to a charity. Both options have their merits, and whether you prioritize financial gain or philanthropy, there’s an option that suits your needs best.

Pros of Donating a Car

Donating your car offers several compelling advantages. First and foremost, it provides a hassle-free and convenient way to dispose of your junk car. Unlike the lengthy process of dealing with potential buyers or junkyards, charities are usually eager to accept your car in any condition, often even offering free towing services. Additionally, donating your car to a registered charity allows you to enjoy potential tax benefits.

By obtaining documentation from the charity about the car’s donation and sale value, you can claim a tax deduction, providing a financial incentive for your philanthropic gesture. Moreover, contributing to a charitable cause can evoke a sense of fulfillment, knowing that your car’s donation is making a positive impact on the lives of others.

Easy and Hassle-Free

Donating your car to a charity is a straightforward process that saves you time and effort. Unlike selling to potential buyers or junkyards, charities often accept junk cars in any condition and may even offer to tow it away at no cost to you.

Tax Benefits

One of the significant advantages of donating your car to charity is the potential tax benefits. By providing documentation of the donation and the sale value of the car, you can claim a deduction on your taxes. Although the actual deduction may not be substantial for donated junk cars, if the charity decides to keep the car and use it, you can claim its fair market value, resulting in a more significant tax claim.

How to Donate Your Car

To donate your car, reach out to reputable charities such as the Car Donation Foundation, Cars4Kids, or 800 Charity Cars. The process is as simple as contacting them and arranging a pickup. Ensure that the charity is a registered 501(c)(3) organization to qualify for the tax deduction.

Cons of Donating Your Car

While donating your car to charity has its merits, there are also some drawbacks to consider. The most significant downside is that you won’t receive any direct financial gain from the donation. Unlike selling your car, where you could immediately have cash in hand, donating means forfeiting potential earnings. Additionally, the tax benefits may not be as substantial as expected for donated junk cars, as charities often sell them at low prices.

If you were hoping for a significant tax deduction, donating might not be the most financially advantageous option. Nevertheless, it’s essential to weigh these cons against the satisfaction of supporting a charitable cause and making a positive difference in the lives of others.

No Direct Financial Gain

The primary downside of donating your car is that you won’t receive any direct financial benefit from the donation. Selling a junk car, either as a whole or for parts, could provide you with instant cash that you could use for other purposes.

Pros of Selling Your Car

Selling your car comes with several enticing advantages. The most notable benefit is the immediate financial gain you’ll receive. Unlike donating your car, which doesn’t offer direct monetary rewards, selling allows you to access cash promptly. This money can be used for various purposes, such as covering the initial installment for your next vehicle or addressing other financial needs. Additionally, selling your car offers the potential for higher earnings. Through negotiation and finding the right buyer, you can secure a better price, especially if your car is in good condition. This aspect of selling presents an opportunity to maximize your financial returns compared to donating it to a charity.

Immediate Financial Gain

Selling your junk car offers a direct cash payment, providing immediate financial relief. This money can be used to cover your next car’s initial installment or any other expenses you may have.

Potential for Higher Earnings

When selling your car, you have the opportunity to negotiate and get a higher price, especially if your car is still in decent condition. Charities usually sell donated cars at low prices, which might not maximize your potential earnings.

Cons of Selling Your Car

While selling your car can be financially rewarding, it also comes with some drawbacks to consider. The most significant con is the potentially prolonged selling process, especially if your car is in poor condition or lacks demand in the market. Finding the right buyer at the desired price may take time and effort, requiring patience on your part.

Additionally, selling your car as separate parts, if it’s not in working order, could be even more challenging and time-consuming. Another aspect to consider is the emotional attachment to your car, as parting with it might be difficult for some individuals. Nonetheless, weighing these cons against the financial benefits is crucial in making the right decision for your specific situation.

Longer Selling Process

Selling a junk car, especially if it’s in poor condition, might take longer than expected. Finding the right buyer can be challenging, and you might need to be patient during the process.

Our Expert Opinion

At Charity Appraisal, we understand that the decision to sell or donate your junk car is a personal one, guided by your priorities and values. If you prioritize simplicity, philanthropy, and potential tax benefits, donating your car could be the perfect fit for you.

Our team is here to assist and offer guidance throughout the donation process. On the other hand, if immediate financial gain and maximizing your earnings are your primary concerns, selling your car might be the preferred route.

We want our clients to make informed choices, so carefully weigh the pros and cons, and rest assured that whether you choose to “donate my car” or sell it, your decision will have a positive impact, aligning with your individual values. Our professional and impartial assistance is always available to support you in this important decision.